Benign0 is just as clueless as “Benigno”

Yes, you read it right.

We’re talking about Benign0 (the “Get Real Philippines” guy who uses the “Jimi Hendrix” avatar on the left) being just as clueless as his “namesake” Benigno S. Aquino III. Why so?

Because just like his “namesake” Benigno S. Aquino III, benign0 is rabidly against Constitutional Reform, and just recently came out with a new article that highlights his total lack of insight and analytical ability when he attacks the notion of removing the blanket anti-Foreign Direct Investment restrictions found in the 1987 Constitution which actively discourage Multinational Corporations (aka “MNC’s”) and Foreign Direct Investments (aka “FDI”) from coming into the Philippines.

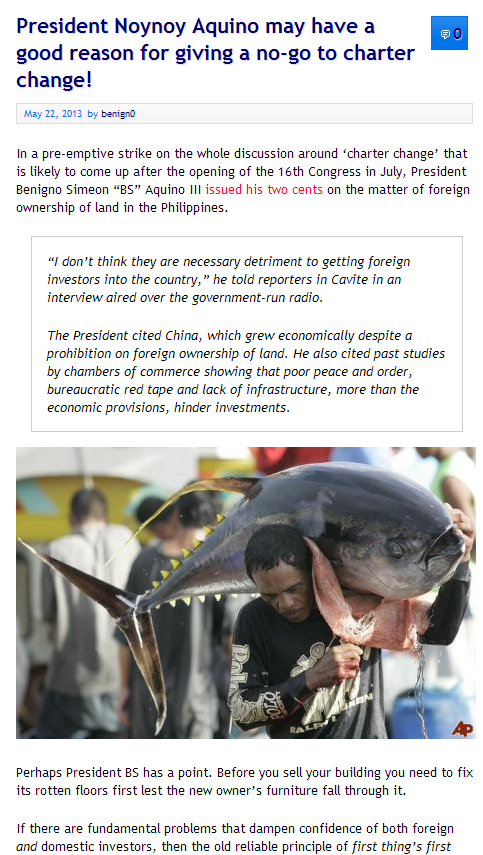

Check this screenshot out:

Oh wow. Really, benign0? Do you really think that your namesake’s point was “before you sell your building you need to fix its rotten floors first lest the new owner’s furniture fall through it?” Or did you not realize that your namesake is just simply clueless, doesn’t know anything about economics, and is simply out to protect the monopolistic vested interests of fellow members of the oligarch class that he was born into?

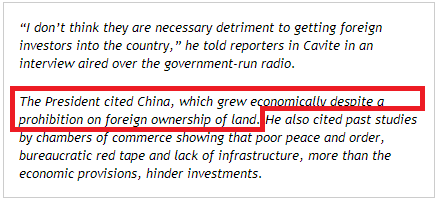

Wait a minute, benign0, did you not see the blatant error that your namesake Benigno S. Aquino III made? It’s this one here:

Did you not notice the error, benign0?

Did your “critical thinking faculties” fail you when you could not see that your namesake Benigno S. Aquino III committed a major logical blunder when he introduced a fallacy in the form of a “red-herring?”

Perhaps you do not get it despite me pointing out to you in red what the fallacious snippet was…

You see, benign0, it seems like you – just like your clueless namesake Benigno S. Aquino III aka “Noynoy” – are incapable of understanding the difference between:

(1) Business/Corporate Ownership by foreigners

(2) Land/Real Estate Property Ownership by foreigners

As it turns out, your namesake Benigno S. Aquino III was trying to mislead the Filipino Public that the whole “60/40” and “anti-Foreign Investor restrictions” issues are related to the whole Land Ownership issue. They are not.

One is about whether or not Foreigners are to be allowed to own businesses or perhaps limiting them to a small minority share of entire businesses, while the other one is about allowing Foreigners to own land. They’re totally different issues altogether.

What matters primarily to MNC’s and Foreign Direct Investors is whether the country in question freely allows or restricts foreign entities to own businesses in the country. As we all know, countries that are more open to allowing majority ownership of corporations and businesses or even allow up to 100% ownership by foreigners are more likely to be able to attract foreign direct investors than those countries that are more closed. That is obvious.

Allowing land ownership to foreigners on the other hand, is merely a secondary or “extra” feature that can help bring in more investors. It is possible for countries to allow 100% corporate ownership by foreigners, but ban the ownership of land by foreigners. China and Vietnam are countries that allow foreigners to own up to 100% of companies, but prohibit everybody – both foreigners and local citizens – from owning any free-hold real estate property.

President Benigno S. Aquino III aka “Noynoy” simply couldn’t make the distinction between the two. He either didn’t know anything about the topic and made an erroneous statement showing his sheer ignorance and inability to distinguish between the two issues of “corporate ownership” versus “land ownership” or he was actively trying to distract the public by using the “land ownership issue” as a kind of smokescreen distraction to throw everyone off the real issue.

How could you miss that, benign0?

Weren’t you supposed to be intelligent? Aren’t you supposed to engage in critical thinking?

Looks to me like you were following “the other Benigno.” Don’t you remember Obi-wan’s famous words, eh benign0?

* * *

Here’s how it works, Ladies and Gentlemen:

For benign0, the Philippines should not even attempt to try to emulate the tried and tested best practices of Singapore’s “Third World to First” strategy in trying to create massive employment opportunities for their people by removing all sorts of anti-FDI restrictions and actively inviting as many Multinational Corporations and Foreign Direct Investors to set up local operations in order to hire as many local employees as possible, thus easing (and eventually eliminating) the persistent unemployment problem. GRP’s webmaster benign0 seems to have actively ignored (or perhaps forgotten) that Singapore was not the only country that actively employed the “actively invite MNC’s and FDI’s in by removing anti-FDI restrictions” strategy.

Let’s see… Aside from Singapore, here are examples of countries who actively dismantled anti-FDI restrictions in order to bring in massive MNC-and-FDI inflows that caused rapid job creation for their people, resulting in the step-by-step reduction of poverty and many of the other issues that result from poverty:

1) Malaysia under Mahathir bin Mohamad

2) China under Deng Xiaoping (邓小平)

3) India under Narasimha Rao

4) Vietnam under the current “Communist” Party of Vietnam

5) Indonesia under Susilo Bambang Yudhyono

6) Cambodia under the late Norodom Sihanouk

Singapore started the ball-rolling.

It was Singapore that went against the grain of most people in the “Developmental Economics” field which had long since been dominated by Marxists and other ideologically-fixated proponents of the “closed economy”-centric and autarky-based “national industries” model of development which erroneously held the zero-sum theory that “economics means that if one makes money, someone else loses money” as opposed to the win-win theory that economics involves a free exchange of value wherein both parties have a net gain as a result of the exchange than prior to when the exchange occurred.

Thanks to the aggressive policy of bringing in MNC’s into Singapore and getting them to create so many jobs, the Singaporean public now gained a huge purchasing power and people who previously had little or no income now had incomes that would allow them to feed themselves and pay for their most basic needs.

It is no wonder that the rest of the ASEAN region and many in the wider Asian Region are emulating Singapore’s “bring-MNC’s-in” approach by removing anti-FDI restrictions in their laws and economic policies.

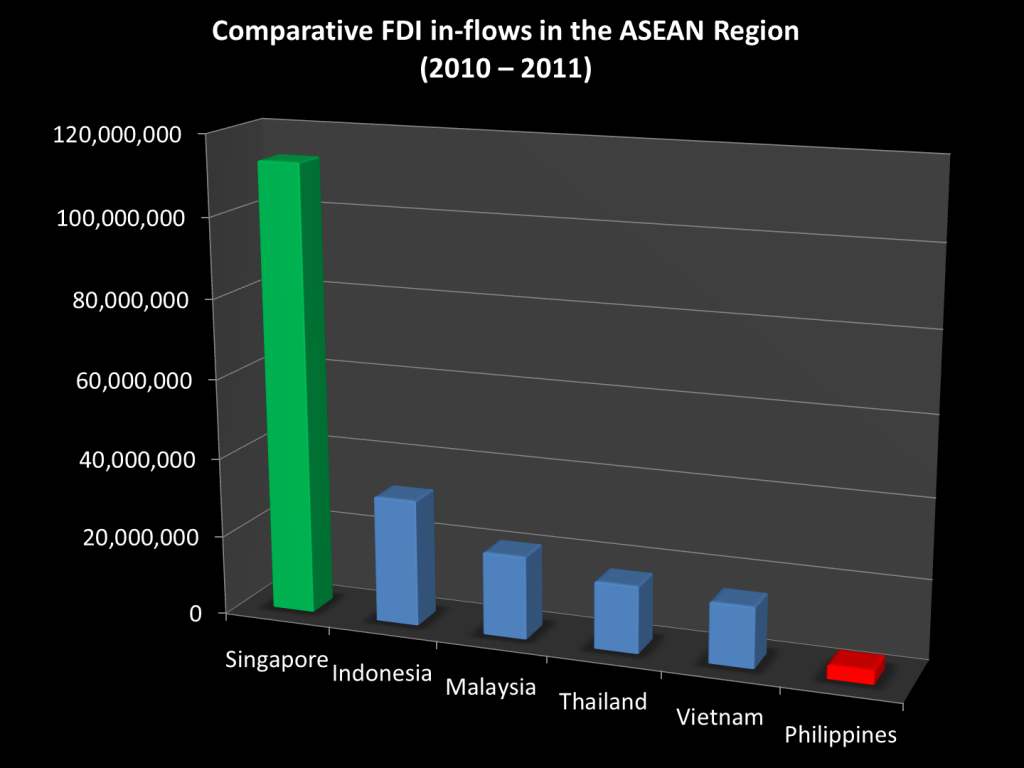

Let us review how things turned out on the FDI-inflows front in ASEAN back in the period of 2010-2011:

Alright. Let’s look at those values so that we all have a good sense of comparison:

Singapore 113,000,000 Indonesia 32,000,000 Malaysia 21,000,000 Thailand 17,000,000 Vietnam 15,400,000 Philippines 3,500,000

As you can all see from the graph, Singapore is pretty much “off-the-charts.”

I colored it GREEN just to show that it is the leading country in the pack. The laggard is colored RED. Poor laggard. Poor us. We’re the unfortunate laggard: the “runt of the litter.”

And we’re the laggard because we are the weakest as far as FDI inflows are concerned. Oh wait a minute! Yes, that also corresponds with the fact that among all these countries listed in the graph, we also happen to be the country with the worst incidence of unemployment and underemployment. Oops!

And First World Singapore is the country that happens to have the highest FDI inflows. Hmmm… Is this a coincidence? Or is this clearly connected?

Well obviously it is connected! Attracting FDI’s and MNC’s to come to Singapore was precisely the reason why Singapore became a First World country in just around 30 years in the first place. Malaysia, for the longest time, also had the second best FDI-inflows, and that’s why Malaysia had also been one of the more dynamic and better countries in the region, seen as being second to Singapore, often “stealing opportunities” from Singapore by touting itself as a half-priced Singapore. It just so happens that Indonesia decided to really work hard at getting more FDI’s flowing in because their leadership is dead serious on job creation and real economic development.

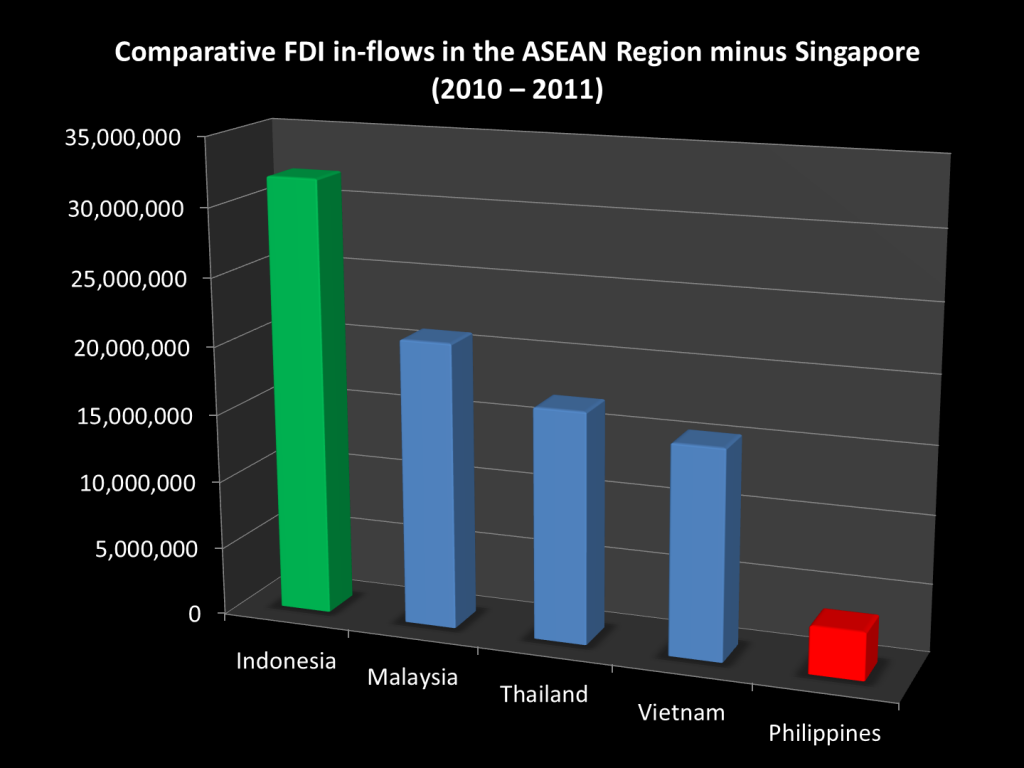

Ok. Since Singapore is already a First World country and it pretty much is in the league of the Big Boys (the Western Countries plus Japan — oh wait… It bested Japan to become the richest country in Asia based on GDP per capita!), so to be fair, let’s compare ourselves among other third worlders. Let’s take Singapore out of the picture:

Geez, we’re looking really really bad here!

In the first graph where Singapore was around, the inclusion of the First World country, its FDI-attraction figures totally dwarfed everyone else’s, so in a way, the Philippines kind of didn’t look that bad since “everyone else was dwarfed by Singapore.”

But looking at this second graph, with Indonesia taking top spot (in GREEN) our status as the worst country in the region as far as unemployment and FDI-inflows is concerned should wake everyone up.

It should wake benign0 up, since it was he who said:

Thus spake the clueless one.

Thus spake the clueless one.

“Reliance on foreign capital and foreign commercial activity is an obsolete concept embraced by losers.”

Now that was one of the most ridiculous things I’ve ever read coming from benign0…

Clearly, benign0 just doesn’t get it.

He simply hasn’t read up on economics and economic history enough to realize that it is actually the AUTARKY-based “Import Substitution”, “Closed Economy” and “National Industries” economic model that is obsolete. It has already been proven time and time again to be the slower and more-prone-to-failure approach to economic development.

He simply hasn’t realized that it is the Open Market concept of freely allowing FDI’s and MNC’s to freely flow in that has worked the best and the fastest in transforming poorer countries to become richer countries.

benign0 also forgets that the country he emigrated to – Australia – is the result of a huge Foreign Direct Investment venture by the British Empire. Worse, he ignorantly forgets that many industries in Australia were started by British foreign direct investors and Australia’s mining industry was actually jumpstarted by foreign companies. Ho boy.

The guy needs to do some research (which, by the way he never does which is why he always loses to me in debates during the few chances that I have the time to engage that slacker), but of course, he is lazy to read. He hasn’t even read Lee Kuan Yew’s “From Third World to First” which he bought, and if he read it, he would have realized that the cornerstone of Singapore’s rapid rise to First World status was its openness to foreign direct investments.

Would you believe this was in Singapore back when it was still “Third World” — …Akala mo siguro nasa Pinas, ano?

(Take time to notice how the photo of Singapore back when it was still “Third World” looks very much like a scene from the rural Philippines. Well, obviously, just looking below, one can see just how Singapore got built up into a First World international hub of business all thanks to Foreign Direct Investments.)

Benign0 doesn’t realize that Marina Bay Sands, Singapore’s new representative landmark, is a Foreign Direct Investment by Sands of Las Vegas

Singapore is just one case in point, but in Western Europe, the old perennial laggard Ireland too became one among the fastest growing economies in the world at the time that the Asian Tigers (yes, including Singapore) were getting a whole lot of attention, giving it the monicker the “Celtic Tiger.”

How did Ireland do it? Simple: It did what Singapore did…

It allowed FDI and MNC’s to come in and create lots of jobs for their people!

In the end, FDI and MNC-attraction was the key in all these examples of fast-growing “former laggards” who got their acts together.

Even benign0‘s ignorance of Philippine Economic history gets highlighted as he clearly doesn’t even realize that the very reason for why the Philippines was “second only to Japan” back in the 1950’s and 1960’s was because of the post-war reconstruction programmes that the Americans helped us out with. True, they sent us aid. They paid “rent” for the US military bases on Philippine soil back then. But most importantly, they sent in hundreds, even thousands of American investors and corporations to invest in the Philippines to create jobs.

Luckily, despite all the existing anti-FDI legislation that had been existing as well as the anti-FDI public utilities and natural resource provisions in the 1935 Constitution, the Philippines inserted a new amendment into the 1935 Constitution that allowed all American citizens and American entities to enjoy the same economic rights guaranteed to Filipino citizens and Filipino entities. This was known as the Parity Rights Amendment. As such, many American companies did not have to deal with whatever 60/40 rules existed in legislation in certain sectors. Whatever Filipinos could own, Americans could own too. There were just so many Americans and American companies in the Philippines at the time so that a lot of employment was generated by the massive hiring that American companies did.

Alright. So now it’s clear.

benign0 simply doens’t know what he’s talking about. (As usual. He comments about a lot of stuff he hasn’t done any research on)

Rather than actively looking for solutions that could make the Philippines a better place, he’d simply prefer to just yak and yak about how “Filipinos are destined to be losers” or how “Filipinos will never succeed” or how “Foreign Investments are a shortcut to success.”

That last idea is the whole point of why we are fighting for the removal of all those anti-FDI Constitutional restrictions! Yes indeed, Foreign DIRECT Investments are a shortcut to success! There’s nothing wrong with taking shortcuts that work and have no side-effects.

Why take the long and painful route of forcing autarky upon ourselves through the use of a closed economy when we can take the tried and tested faster way of rapidly creating massive employment for millions of Filipinos simply by removing all of those anti-FDI restrictions that shoo MNC’s and foreign investors away?

(I mean, come on, everyone else is using the short-cut route already! Everyone else in the ASEAN region is going with the MNC-attraction strategy. Why should we make things harder for ourselves than it should be?)

Is benign0 a masochist? Or does he just want Filipinos to continue to suffer when in fact bringing FDI’s in is one way of creating jobs and training opportunities that can jumpstart economic development?

As it turns out, it looks like benign0 just really prefers to see Filipinos continue to fail, because that justifies to him that his decision to leave the Philippines back in 2000 to emigrate over to Sydney was “the right one.” After all, should the Philippines improve itself after he left, it could make him and his wife Ilda think that they jumped the gun and quit.

How can benign0 actively go against Constitutional Reform (particularly economic liberalization as discussed in this article) when it is obviously the key missing ingredient in the Philippines’ quest to move up the value chain and get rid of its massive unemployment, poverty, overdependence on OFW Remittances, and its host of so many other social issues derived from all those I’ve just mentioned?

Oh well. The obvious conclusion anyone can get from reading this article is simply that the benign0 from GRP is just as clueless as the other Benigno (Aquino III) from Hacienda Luisita.